Managing payroll in Washington state requires careful consideration of various factors, including taxes, deductions, and compliance with state and federal regulations. A Washington payroll calculator can be a valuable tool for employers, helping them navigate the complexities of payroll processing and ensure accuracy in their calculations. In this article, we will delve into the world of payroll calculation in Washington, exploring the key components, challenges, and best practices for employers.

Understanding Washington Payroll Taxes

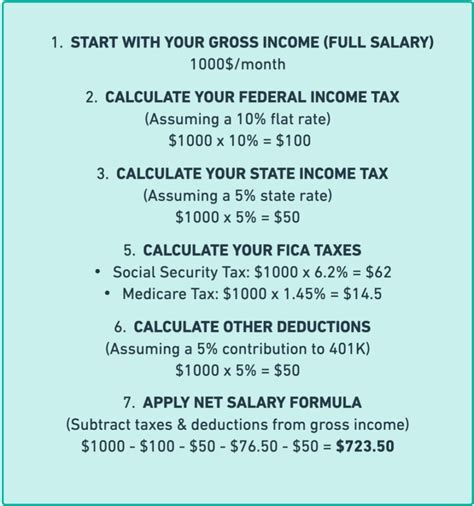

Washington state has a unique tax landscape, with no state income tax but a business and occupation (B&O) tax that applies to most businesses. Employers must also consider federal taxes, including Social Security and Medicare taxes. When using a Washington payroll calculator, it’s essential to understand the different tax rates and how they apply to various types of income. For example, the Social Security tax rate is 6.2% for employees and 6.2% for employers, while the Medicare tax rate is 1.45% for both employees and employers.

Breaking Down Washington Payroll Taxes

A Washington payroll calculator typically takes into account the following taxes and deductions: * Federal income tax withholding * Social Security tax (6.2% for employees and 6.2% for employers) * Medicare tax (1.45% for both employees and employers) * Washington state B&O tax (varies depending on business type and income) * Other deductions, such as health insurance premiums and 401(k) contributions By accurately calculating these taxes and deductions, employers can ensure compliance with tax regulations and avoid potential penalties.

| Tax Type | Employee Rate | Employer Rate |

|---|---|---|

| Social Security Tax | 6.2% | 6.2% |

| Medicare Tax | 1.45% | 1.45% |

| Washington B&O Tax | Varies | Varies |

Key Considerations for Washington Payroll Calculators

When choosing a Washington payroll calculator, employers should consider the following key factors: * Accuracy and compliance with tax regulations * Ease of use and user interface * Ability to handle various types of income and deductions * Integration with accounting and HR systems * Customer support and training resources By evaluating these factors, employers can select a payroll calculator that meets their specific needs and helps them streamline their payroll processes.

Best Practices for Using a Washington Payroll Calculator

To get the most out of a Washington payroll calculator, employers should follow these best practices: * Regularly update tax rates and regulations to ensure compliance * Verify employee data and income information for accuracy * Use the calculator to track and manage deductions, such as health insurance premiums and 401(k) contributions * Reconcile payroll calculations with actual payments to ensure accuracy * Seek support and training from the calculator provider as needed By following these best practices, employers can ensure accurate and compliant payroll calculations, reducing the risk of errors and penalties.

Key Points

- Understand Washington state tax regulations, including B&O tax and payroll taxes

- Choose a Washington payroll calculator that is accurate, user-friendly, and compliant with tax regulations

- Regularly update tax rates and regulations to ensure compliance

- Verify employee data and income information for accuracy

- Use the calculator to track and manage deductions, such as health insurance premiums and 401(k) contributions

Washington Payroll Calculator FAQs

What is the Washington state B&O tax rate?

+The Washington state B&O tax rate varies depending on the type of business and income. For example, the retailing B&O tax rate is 0.471%, while the manufacturing B&O tax rate is 0.484%.

How do I calculate Social Security tax in Washington state?

+To calculate Social Security tax in Washington state, multiply the employee’s income by 6.2% for the employee portion and 6.2% for the employer portion.

Can I use a Washington payroll calculator for multiple businesses?

+Yes, many Washington payroll calculators allow you to manage multiple businesses and calculate payroll taxes for each business separately.

Meta description: “Discover the ins and outs of Washington payroll calculation, including taxes, deductions, and compliance. Learn how to choose the right payroll calculator for your business and ensure accurate calculations.” (149 characters)