As a tax professional, managing client accounts and preparing tax returns efficiently is crucial for a successful practice. Lacerte is a comprehensive tax preparation software designed to streamline the tax preparation process, offering a range of tools and features to enhance productivity. To get the most out of Lacerte, it's essential to understand its capabilities and how to navigate its interface effectively. In this article, we will delve into five Lacerte account tips that can help tax professionals optimize their workflow, improve client management, and increase overall efficiency.

Key Points

- Utilizing the client management features in Lacerte to organize and track client information

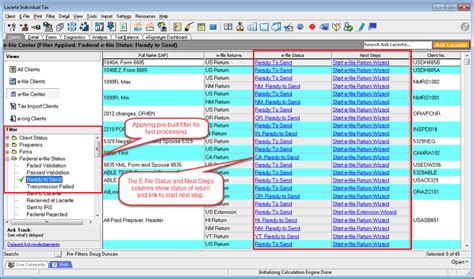

- Implementing a workflow that integrates e-filing and electronic signature tools for streamlined tax return processing

- Leveraging Lacerte's diagnostics and analysis tools to identify potential issues and optimize tax savings

- Customizing the software to fit your specific practice needs through preferences and settings

- Staying updated with the latest Lacerte features and best practices through training and support resources

Understanding Lacerte’s Client Management Capabilities

Lacerte’s client management features are designed to help tax professionals organize and track client information efficiently. By utilizing these tools, you can create detailed client profiles, manage documents, and track the status of tax returns. This not only enhances client satisfaction but also reduces the administrative burden on your practice. For instance, you can use Lacerte to send automated reminders and notifications to clients, ensuring they stay informed about the progress of their tax returns.

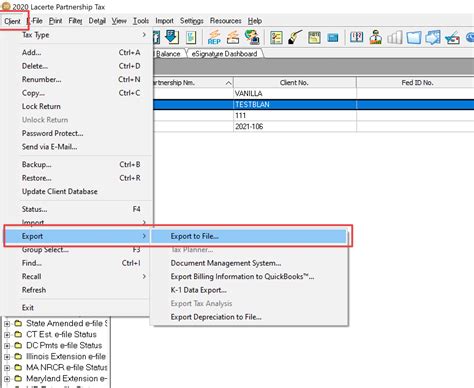

Customizing Your Workflow with Lacerte

A key aspect of optimizing your use of Lacerte is customizing the software to fit your specific practice needs. This can involve setting up workflows that integrate e-filing and electronic signature tools, allowing for a more streamlined tax return process. By reducing the need for physical signatures and manual filing, you can significantly decrease processing times and improve client satisfaction. Furthermore, Lacerte’s diagnostics and analysis tools can help identify potential issues with tax returns, ensuring compliance and maximizing tax savings for your clients.

| Feature | Description |

|---|---|

| Client Management | Tools for organizing and tracking client information |

| E-Filing and Electronic Signatures | Streamlined processing of tax returns |

| Diagnostics and Analysis | Identification of potential issues and optimization of tax savings |

| Customization Options | Preferences and settings for tailoring the software to your practice |

| Training and Support | Resources for staying updated with the latest features and best practices |

Maximizing Efficiency with Lacerte’s Diagnostics and Analysis Tools

Lacerte’s diagnostics and analysis tools are powerful features that can help tax professionals identify potential issues with tax returns and optimize tax savings for their clients. By leveraging these tools, you can analyze tax returns for errors, identify areas where tax savings can be maximized, and ensure compliance with the latest tax laws and regulations. This not only enhances the quality of service you provide to your clients but also helps to build trust and credibility in your practice.

Staying Updated with the Latest Lacerte Features and Best Practices

Finally, it’s essential to stay updated with the latest Lacerte features and best practices to ensure you’re getting the most out of the software. This can involve participating in training sessions, webinars, and workshops, as well as accessing online resources and support forums. By staying informed about new features and updates, you can continually improve your workflow, enhance client satisfaction, and maintain a competitive edge in the market.

How can I customize Lacerte to fit my practice's specific needs?

+You can customize Lacerte by exploring and configuring its preferences and settings. This allows you to create a workflow that is tailored to your specific requirements, enhancing efficiency and productivity.

What are the benefits of using Lacerte's diagnostics and analysis tools?

+The diagnostics and analysis tools in Lacerte can help identify potential issues with tax returns, ensure compliance, and optimize tax savings for clients. This enhances the quality of service provided and builds trust and credibility in your practice.

How can I stay updated with the latest Lacerte features and best practices?

+You can stay updated by participating in training sessions, webinars, and workshops, as well as accessing online resources and support forums. This helps you continually improve your workflow, enhance client satisfaction, and maintain a competitive edge in the market.

In conclusion, by understanding and leveraging the capabilities of Lacerte, tax professionals can significantly enhance their workflow, improve client management, and increase overall efficiency. Whether it’s customizing the software to fit your practice’s specific needs, utilizing diagnostics and analysis tools, or staying updated with the latest features and best practices, there are numerous ways to optimize your use of Lacerte. By implementing these strategies, you can provide a higher quality of service to your clients, build trust and credibility in your practice, and maintain a competitive edge in the ever-evolving landscape of tax preparation.